As you near retirement, you'll have questions and need information. This website will help guide you from your initial thoughts to the first few weeks after your retirement.

STEP 1: IDENTIFY YOUR RETIREMENT PLAN

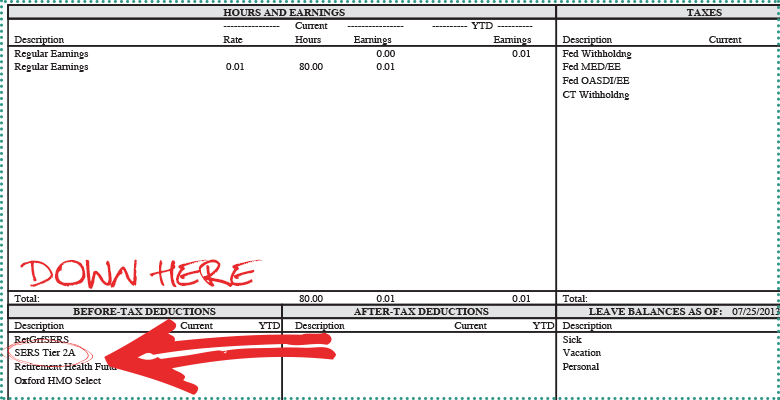

How to Identify Your Retirement Plan

The State of Connecticut has a number of different retirement plans, so -- if you're unsure -- you'll need to identify your retirement plan. To do so, look at the "Before-Tax Deductions" section of your current paycheck. That will show your retirement plan and the amount you are contributing while working. Once you leave state service, you won't make contributions toward a retirement plan. You can find copies of your recent paystubs in Core-CT.

STEP 2: DETERMINE WHEN YOU ARE ELIGIBLE TO RETIRE

When Am I Eligible to Retire?

The chart below shows the minimum requirements to begin collecting a benefit under your retirement plan. Please note that if you are one of the few employees who participates in Teachers’ Retirement (TRB), please visit their website are https://portal.ct.gov/trb.

| RETIREMENT PLAN | MINIMUM REQUIREMENTS TO COMMENCE BENEFITS |

|---|---|

| Alternate Retirement Program (ARP) | You have access to your ARP account starting at age 55 if you no longer work for the State of Connecticut in any capacity, including Special Payroll. (Note: If you leave state service with less than 10 years of participation in ARP, there is no minimum age to access your ARP account.) |

| State Employees Retirement System (SERS) Plans | |

| Tier I | Non-Hazardous Duty

Age 55 with 10 or more years of actual service |

| Tier I | Hazardous Duty

Any age following 20 years hazardous duty service |

| Tier II & Tier IIA | Non-Hazardous Duty

Age 55 with 10 or more years of vesting service |

| Tier II & Tier IIA | Hazardous Duty

Any age following 20 years hazardous duty service |

| Tier III | Non-Hazardous Duty

Age 58 with 10 or more years of vesting service |

| Tier III | Hazardous Duty

Any age following 25 years hazardous duty service, |

| Tier IV | Non-Hazardous Duty

Age 58 with 10 or more years of vesting service |

| Tier IV | Hazardous Duty

Any age following 25 years hazardous duty service |

| Hybrid Plan | Refer to underling Tier Plan |

If you are participating in a Non-Hazardous Duty SERS Plan, it’s important to know that your monthly pension benefit will be reduced if you retire prior to meeting the requirements for a normal retirement. The reduction is ½% for each month early you retire (6% per year). This is a permanent reduction in your monthly pension benefit. Below is a chart that reflects the requirements to retire without a reduction factor.

| SERS Retirement Plan | Normal Retirement Age and Service Requirements |

|---|---|

| Tier I | Age 55 with 25 years of actual service, or Age 65 with 10 years of service |

| Tier II & Tier IIA | Retirement date prior to 7/1/22 or if grandfathered: Age 60 with at least 25 years of vesting service, or Age 62 with at least 10 years of vesting service Retirement date on or after 7/1/22: |

| Tier III & Tier IV | Age 63 with at least 25 years of vesting service, or Age 65 with at least 10 years of vesting service |

| Hybrid Plan | Refer to underlying Tier plan |

STEP 3: DETERMINE WHEN YOU QUALIFY FOR RETIREE HEALTH BENEFITS

When Will I Qualify for Retiree Health Benefits?

Employees who retire under their retirement plan may also qualify for retiree health benefits if they meet the eligibility requirements. You will need to know your hire date in a position that provides retirement benefits, your years of service, and your retirement plan. You can request this information from Melody Williamson if you are unsure. You can then use the chart below to determine the eligibility requirements that apply to you.

| Hire Date into a Retirement-Eligible State Position | Retiree Health Plan Eligibility Requirement |

|---|---|

| Prior to July 1, 1997 | At least age 55 with 10 or more years of service |

| July 1, 1997 through June 30, 2017 |

Refer to Division Memorandum 2013 |

| On or after July 1, 2017 | If transitioning directly to retirement: - At least age 58 with 15 or more years of service. If voluntarily leaving state service prior to commencing a pension benefit: |

STEP 4: ESTIMATE YOUR RETIREMENT INCOME

Retirement Income

Most people have three sources of income in retirement: retirement plan, Social Security and retirement savings. These benefits will vary based on the retirement date you select. Online estimators help you project what you will receive based on the retirement dates you enter.

Income Based on the Retirement Plan in Which You Participate

ARP

You have many withdrawal options available, including the option to purchase an annuity that provides you with a monthly benefit for life. More information is available at www.ctdcp.com.

SERS Tier Plans

You collect a lifetime monthly pension benefit based on a formula that takes into consideration your age, years of service, and average earnings. At retirement, you will select one of the following survivor payment options: Straight Life Annuity (no survivor benefits payable); 50% Spouse; 50% or 100% Survivor; 10- or 20-Year Period Certain. The amount of your monthly pension benefit is adjusted under each of these payment options. The State provides an online estimating tool and more at the following website: https://www.osc.ct.gov/rbsd/stateretire.htm.

Hybrid Plans

You have an option at retirement. You can collect a monthly pension benefit for your lifetime (same as the SERS Tier Plans) or you can cash out your pension.

Social Security Income

You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits when you reach your full retirement age. The following is a link to a chart that reflects your full retirement age based on your date of birth: https://www.ssa.gov/benefits/retirement/planner/agereduction.html. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

Social Security Administration provides an online tool that you can use to estimate your monthly benefits using different dates at the following website: www.ssa.gov.

Retirement Savings

The State offers employees tax-favored savings programs to help save for retirement: 403(b), Roth 403(b), 457 and Roth 457. For information about accessing these funds in retirement visit www.ctdcp.com.

STEP 5: ESTIMATE YOUR HEALTH CARE COSTS IN RETIREMENT

Employees who retire and qualify for retiree health insurance can use the charts below to determine the current costs in retirement. It’s important to note that employees who retire early contribute more until they reach their normal retirement age. Participants under age 65 have the same medical options available to employees. Participants age 65 and older are covered under a Medicare Advantage Program through Aetna.

Early Retirees

Minimum 10 years of service at age 55, except age 58 for SERS Tier 3 and 4

Employees who retire prior to their normal retirement pay a higher share of the premium each month until they reach their normal retirement age. The percentage of the premium they pay is based on their years of service and how early they are retiring, as is shown in the chart below.

Percentage of Total Premium Paid by Early Retirees

| Years of Service | 5 or more |

4 |

3 |

2 | 1 |

|---|---|---|---|---|---|

| 15 or less | 40.0 | 32.0 | 24.0 | 16.0 | 8.0 |

| 16 |

37.0 | 29.6 | 22.2 | 14.8 | 7.4 |

| 17 |

34.0 | 27.2 | 20.4 | 13.6 | 6.8 |

| 18 |

31.0 | 24.8 | 18.6 | 12.4 | 6.2 |

| 19 |

28.0 | 22.4 | 16.8 | 11.2 | 5.6 |

| 20 |

25.0 | 20.0 | 15.0 | 10.0 | 5.0 |

| 21 |

22.0 | 17.6 | 13.2 | 8.8 | 4.4 |

| 22 |

19.0 | 15.2 | 11.4 | 7.6 | 3.8 |

| 23 |

16.0 | 12.8 | 9.6 | 6.4 | 3.2 |

| 24 |

13.0 | 10.4 | 7.8 | 5.2 | 2.6 |

| 25 or more |

10.0 | 8.0 | 6.0 | 4.0 | 2.0 |

The premium percentages are prorated by months. The percentage at retirement applies to all years early (no adjustment each year).

After you identify your percentage from the chart above, you multiply it by the Total Premium. Retirees can change their option each year during the annual open enrollment. Please note that these are the premiums for persons who are under age 65. Select the column based on the number of persons you are covering who are under age 65. Note: Persons age 65 and older will have a different plan, which is described in the section Retirees/Spouses Age 65 or Older.

Below is the chart that reflects the total monthly premiums for the 2023-2024 plan year.

2024-25 Total Monthly Premiums for Persons Under the Age 65

| Medical Plans | 1 Person | 2 Persons | 3+ Persons |

|---|---|---|---|

| Quality First Select Access (Prime Tiered POS) |

$1,224.25 | $2,693.35 | $3,305.47 |

| Primary Care Access (POE-G) | $1,284.43 | $2,825.75 | $3,467.96 |

| Standard Access (POE) | $1,296.06 | $2,851.33 | $3,499.36 |

| Expanded Access (POS) | $1,320.97 | $2,906.14 | $3,566.62 |

| State Preferred POS* | $1,405.96 | $3,093.11 | $3,796.09 |

| Out-of-Area | $1,405.96 | $3,093.11 | $3,796.09 |

*Available only to employees currently enrolled.

It’s important to note that if your result is more than 25% of your actual monthly pension benefit, you will pay 25% of your monthly pension benefit (Cap), unless you work less than full time. The actual pension benefit will be prorated for employees who are less than full time.

Employee retires 2 years early with 20 years of service and is enrolled in the Standard Access (POE) family coverage and has an actual pension benefit of $1,400/month.

Maximum Payable: $1,400 (actual monthly pension) x 25% = $350

Factor from Table: 10% (payable for 2 years prior to normal retirement age)

Total Premium from Chart for Standard Access (POE): $3,362.60 (2023-24)

Monthly Premium: $3,362.60 x 10% = $336.26 (below the maximum)

Normal Retirees

Minimum age if less than 25 years of service: 65

Minimum age with 25 years or more of service: 55 (Tier 1), 63 (Tier 2, 2A, 3, 4)

Grandfathered (Tier 2 or 2A)

Minimum age if less than 25 years of service: 62

Minimum age with 25 years or more of service: 60

Retirees have an open enrollment each year in which they can make changes to their elections. The State provides employees with the Retiree Health Care Options Planner each year, which includes the monthly costs.

Retirement Dates After 7/1/2022

2025-26 Monthly Premiums for Persons Under the Age 65

Non Hazardous Duty - Retirement date August 1, 2022 or later

| Medical Plans |

1 Person | 2 Persons | 3+ Persons |

|---|---|---|---|

| Quality First Select Access (Prime Tiered POS) |

$71.46 | $157.21 | $192.94 |

| Primary Care Access (POE-G) | $71.28 | $156.81 | $192.45 |

| Standard Access (POE) | $71.94 | $158.27 | $194.24 |

| Expanded Access (POS) | $73.35 | $161.38 | $198.06 |

| Anthem State Preferred POS* | $78.18 | $171.99 | $211.08 |

| Anthem Out-of-Area |

$78.18 | $171.99 | $211.08 |

Hazardous Duty - Retirement date August 1, 2022 or later

| Medical Plans |

1 Person | 2 Persons | 3+ Persons |

|---|---|---|---|

| Quality First Select Access (Prime Tiered POS) |

$42.87 | $94.32 | $115.76 |

| Primary Care Access (POE-G) | $42.77 | $94.09 | $115.47 |

| Standard Access (POE) | $43.16 | $94.96 | $116.54 |

| Expanded Access (POS) | $44.01 | $96.83 | $118.83 |

| State Preferred POS* | $46.91 | $103.20 | $126.65 |

| Out-of-Area |

$46.91 | $103.20 | $126.65 |

*Available only to employees currently enrolled.

Retirees/Spouses Age 65 or Older

Retirees and their spouses who are age 65 or older have one plan option in retirement, the Medicare Advantage Program. To qualify for this plan, the person must be enrolled in both Medicare Part A and Medicare Part B on the first of the month following their retirement date. Please note that retirees and spouses age 65 or older must enroll for Medicare Part A and B with Social Security and must provide proof of enrollment to the State. The State will then handle the enrollment in the Medicare Advantage Program and Medicare Part D.

The Medicare Advantage Program is a full replacement to Medicare and was designed to closely resemble the out-of-pocket costs of the active employee coverage. There is no premium required for this plan.

Below is a chart that shows what Social Security will charge participants each month in 2026 for enrollment in Medicare, which is based on a person’s 2024 income tax return. Please note that the State will reimburse the retiree and spouse 100% of the base Medicare Part B premium and 50% of the IRMAA and Part D premiums.

| Yearly Income in 2024 | Participants Pay Each Month in 2026 |

||||||

| File Individual Tax Return |

File Joint Tax Return |

File Married & Separate Tax Return |

Part A |

Base Rate for Part B |

Income Related Adjustment Amount (IRMAA) for Part B |

Part D (Prescription Drugs, DO NOT ENROLL; State will handle the enrollment) |

Total per Person/Month |

| $106,000 or less | $218,000 or less | $109,000 or less | $0 | $202.90 | $0 | $0 | $202.90 |

| above $106,000 up to $133,000 | above $218,000 up to $274,000 | Not applicable | $0 | $202.90 | $81.20 | $14.50 | $298.60 |

| above $133,000 up to $167,000 | above $274,000 up to $342,000 | Not applicable | $0 | $202.90 | $202.90 | $37.50 | $443.30 |

| above $167,000 up to $200,000 | above $342,000 up to $410,000 | Not applicable | $0 | $202.90 | $324.60 | $60.40 | $587.90 |

| above $200,000 and less than $500,000 | above $410,000 and less than $750,000 | above $109,000 and less than $391,000 | $0 | $202.90 | $446.30 | $83.30 | $732.50 |

| $500,000 or above | $750,000 and above | $391,000 and above | $0 | $202.90 | $487.00 | $91.00 | $780.90 |

Dental

Retirees have the same dental options as active employees, but they pay a higher share of the cost. There is an annual open enrollment period in which retirees can change their dental elections. The premiums are published in the annual Retiree Health Care Options Planner. Below are the monthly rates:

2025-2026 Monthly Retiree Dental Premiums

| Coverage Level | Cigna Dental Care DHMO* | Total Care DHMO |

Enhanced |

Basic |

|---|---|---|---|---|

| 1 person | $24.32 | $30.33 | $40.12 | $43.10 |

| 2 persons | $53.50 | $66.72 | $80.24 | $86.21 |

| 3+ persons | $65.66 | $81.89 | $80.24 | $86.21 |

*Closed to new enrollments

Retiree Health Care Options Planner

From the Office of the State Comptroller, review the 2025/2026 Retiree Health Care Options Planner.

STEP 6: REVIEW RETIREE HEALTH BENEFITS FOR PERSONS AGE 65 AND OLDER

If you or your spouse will be age 65 or older when you retire, read more about how the insurance benefits work.

Retiree Health Benefits for Persons Age 65 and Older

- Retiree health benefits begin the month following retirement. During the first month of retirement, retirees retain their current active employee benefits.

- The plan available to persons age 65 and older is the Medicare Advantage Program, currently through United Healthcare (changing to Aetna on January 1, 2023). The features of this plan closely resemble the features of the active employee plans (coverage and copays) and the coverage is provided at no cost to all persons age 65 and older. Note: The only option for continuing the active employee coverage is through COBRA.If other covered family members are under age 65, those persons have the same choice of plans as active employees (at retiree health rates). This means that they will have different coverage from the person(s) age 65 and older.

- There is a prerequisite to be enrolled in the Medicare Advantage Program: The person must be enrolled in Medicare Part A and Part B through Social Security. Medicare Part A generally includes inpatient services and is provided by Social Security at no cost. Medicare Part B, which generally covers outpatient services, has a monthly fee based on a person’s earnings. (Note: Persons do not enroll for any other Medicare programs, such as Part C or Part D, prescriptions) Higher wage earners pay more for Medicare Part B, because Social Security applies an Income Related Monthly Adjustment Amount (IRMAA). When determining how much a person will pay for Medicare Part B, Social Security uses the person’s tax return earnings from two years prior. For example, Social Security reviews 2020 tax returns when determining Part B premiums for calendar year 2022.Each year in a person’s retirement, Social Security will assess the Medicare Part B premium it will charge for the upcoming calendar year.

- The State provides retirees with a reimbursement of the Medicare Part B premium for the retiree and spouse. The reimbursement is 100% of the base premium and 50% of the Income Related Monthly Adjustment Amount (IRMAA) and Medicare Part D premiums. Note: The State assumes that retirees pay Social Security only the base premium unless the retiree provides proof each year that they pay an IRMAA.For monthly pensioners, the reimbursement is added to the monthly pension check. For Alternate Retirement Program (ARP) retirees, the State issues a monthly check.

- Persons age 65 and older must work directly with Social Security to enroll for Medicare Part A and Part B. The enrollment process with Social Security will vary based on the following:

- If Enrolling During Seven-Month Window

Every person has an initial seven-month window when they turn age 65 to enroll for Medicare. The effective date of coverage is automatic when enrolling during this window, regardless of what the person requests. This is important to consider, since the State will not reimburse Medicare Part B coverage prior to the effective date of retiree health benefits (month following retirement).Breakdown of 7-month Window Automatic Effective Date 3 months prior to month of 65 th birthday First of the month of 65 th birthday Month of 65 th birthday First of the month following 65 th birthday Three months after month of 65 th birthday First of the month following enrollment date Example: Person turns age 65 in June and retires July 1. Retiree health benefits begin August 1 (month following retirement), so the person does not want Medicare Part B coverage to begin before that date, which falls within the 7-month window. To make the coverage effective August 1, the person must enroll for coverage during the month of July. Persons who are enrolling outside of their Seven-Month Window have the ability to select their enrollment effective date. Social Security does not accept Medicare applications submitted more than 90 days prior to the requested coverage effective date. For example, a person retiring 7/1 will have a retiree health coverage date of 8/1 and can apply for Medicare no earlier than 5/1.

- If Already Enrolled in Medicare Part A

Social Security has one process for persons who need to enroll in both Medicare Part A and Part B and another process for person who are already enrolled in Part A and need to enroll only for Part B. The online process for enrollment is only for persons who are applying for both Medicare Part A and B. There is no online process for enrolling in only Part B.

- If Enrolling During Seven-Month Window

- Benefits will provide persons age 65 and older with a completed Social Security Form CMS-L564 that the person must provide to Social Security when enrolling for Medicare. This form is proof that the person has been covered by a creditable plan while enrolled in the State’s active employee benefits plan. This is necessary to ensure that the person is not assessed a late entrant penalty, which is not reimbursable by the State.

- Persons age 65 and older must provide Benefits with a copy of their Medicare card showing enrollment in Part A and B. Additionally, persons must provide a copy of the letter received from Social Security indicating what they will be charged for Part B premiums. This information does not have to accompany the retirement application, but should be sent no later than during the first month of retirement.Benefits provides copies to the State, which it then uses to enroll the person in the Medicare Advantage Program and in Medicare Part D (prescription drugs). It also sets up for the reimbursement of the Medicare Part B premiums (100% of the base premium and 50% of IRMAA) and 100% of Medicare Part D, for which there is a charge only for high wage earners.

- Social Security does not permit retroactive enrollment in Medicare and they will not allow the State to enroll persons in the Medicare Advantage Program until the person is enrolled in Medicare Part A and Part B. Generally, if the person’s enrollment in either Medicare or the Medicare Advantage Program is not completed within three weeks prior to the coverage effective date, there will be a delay in the effective date of the Medicare Advantage Program.When this happens, the State sends the retiree a new health card based on the active employee coverage (Anthem). The person should use both the Medicare card (primary) and Anthem card (secondary) when obtaining care and services until the effective date of the Medicare Advantage Program coverage.

- The Medicare Advantage Program is a full replacement to Medicare, not a supplement to it. As such, persons should use only their Medicare Advantage card with doctors, hospitals, pharmacies and other health care professionals. Please note: Persons enrolled in the Medicare Advantage Program are not permitted to be enrolled in any other Medicare insurance program, such as through a spouse’s retirement plan.

- Retiree health benefits are administered by the Healthcare Policy and Benefit Division of the Office of the State Comptroller. Once retired, questions should be directed to them (agencies do not have access to retiree benefits). Contact information is available from their website at www.osc.ct.gov.

STEP 7: READ A GUIDE TO RETIREMENT BENEFITS

Human Resources developed a comprehensive Guide to answer the many questions employees have as they contemplate retirement.

Guide to Retirement Benefits

STEP 8: REVIEW THE RETIREMENT CHECKLIST AND GUIDELINES

Human Resources developed the Checklist and Guidelines to give employees a better understanding of what happens when leading up to retirement and the weeks following retirement.

Checklist and Guidelines

STEP 9: INITIATE RETIREMENT PAPERWORK

Once you decide on a retirement date, you notify Human Resources by completing the Request for Retirement Initiation Packet.

Retirement Paperwork

- You can submit the Request for Retirement Initiation Packet at any time prior to your retirement, but ideally at least three months prior. Your signed retirement forms cannot be dated more than 90 days prior to your retirement date.”

- HR will prepare forms for your signature, and will contact you once they are available. Sign, date, and return retirement forms to HR with Required Proof Documents. Forms require original signatures on single-sided pages. The earliest employees can submit signed retirement paperwork is 3 months prior to retirement.

- For employees or spouses aged 65 or older, HR will send you forms to file for Medicare Part B. You file the paperwork directly with your local Social Security office requesting a coverage effective date of the first of the month following retirement.

- Contact Empower for information on how to defer the tax liability of any final payout. Your final paycheck will automatically include the payout of accruals and contract adjustments for faculty (such as pay through August 22nd). Human Resources recommends employees pursue this step a month before retirement.

- If not yet done, provide written notice to your department of your retirement. HR will notify your department and UConn Payroll after receiving your signed forms.

Review Required Proof Documents Needed at the Time of Retirement

The State requires that employees provide copies of government-issued documents with their retirement application as indicated below:

Birth Certificates

for employee, your spouse (or Contingent Annuitant) and each child to be enrolled in retiree health benefits

Important Notes:

- The name on the birth certificate must match the name on the retirement forms, or be the maiden name as reflected on the marriage certificate (for married participants). If the name is different, court documents can be provided as proof of a name change or the person can complete a Name Affidavit.

- If the birth certificate is not in English, a certified translation must also be provided.

- The State will not accept birth certificates from Puerto Rico issued prior to July 1, 2010.

- Persons born outside of the US who do not have a birth certificate must complete a Birth Affidavit.

Marriage Certificate

for married employees

Important Notes:

- For proof of marriage, the State requires a government issued marriage license/certificate. A religious or ceremonial record is not sufficient. Individuals who are unable to provide a government issued marriage license/certificate must also complete a Marriage Affidavit.

- If the marriage certificate is not in English, a certified translation must also be provided.

- Employees married outside of the US who do not have a marriage certificate must complete a Marriage Affidavit.

Medicare Card

for retirees and spouses age 65 and older who will be enrolled in retiree health benefits

Please note: The Medicare Card does not need to be provided in advance of retirement. Retiree health benefits are effective the month following retirement. The Medicare card is proof of enrollment and is required for reimbursement of Medicare Part B premiums.

Letter from Social Security with Medicare Part B Premiums

for retirees and spouses age 65 and older who will be enrolled in retiree health benefits

Please Note: This letter does not need to be provided in advance of retirement. If you are a higher wage earner who will be subject to an Income Related Monthly Adjustment Amount (IRMAA), you will want to provide a copy of the letter that reflects the IRMAA amount.

STEP 10: POST-RETIREMENT DETAILS

Important information about what happens after your retirement date, including who to contact with questions regarding retirement benefits and reemployment options.

Final Paychecks

Employees generally receive two paychecks following retirement. The first paycheck will be a standard biweekly check. The second will be your final paycheck and will automatically include the payout of accruals, or a contract adjustment for 9- or 10-month faculty.

Receipt of New Medical ID Cards

Retiree health benefits begin on the first of the month following retirement. During the first month of retirement, continue to use your active employee cards. If you or your spouse received a new Medicare Card showing enrollment in Part A and Part B, send a copy to your Human Resources retirement specialist as proof of enrollment, and a copy of the letter from Social Security reflecting Part B costs to be reimbursed.

SERS Pension Benefit

SERS participants will receive a letter from the Retirement Services Division by the end of the first month of retirement identifying the amount of their monthly pension benefit. Pension checks are dated on the last business day of the retirement month. Retirees have online access to pension checks and will be provided access information by the Retirement Services Division.

Payroll Deductions

Benefits

| Paycheck Deductions | Pension Deductions | What Happens in Retirement |

|---|---|---|

| Medical Premiums | Yes | Premiums vary based on coverage, persons covered, retirement type (early, normal, disability) |

| Dental Premiums | Yes | Premiums vary based on coverage, persons covered |

| Retirement Plan Contributions | No | Stop at retirement |

| Grandfather Deductions | No | Stop at retirement |

| Retiree Health Fund Contributions | No | Stop at retirement |

| Life Insurance Premiums | No | Coverage can be continued on direct bill basis |

| Disability Insurance Premiums | No | Stop at retirement |

| Home & Auto Insurance | No | Coverage can be continued on direct bill basis |

| Long Term Care Insurance | Yes | TransAmerica (not automatic, must set up) |

| MEDFLEX | No | Stop at retirement |

| DCAP | No | Stop at retirement |

| 403(b) Savings | No | Stop at retirement |

| 457 Savings | No | Stop at retirement |

Other

| Paycheck Deductions | Pension Deductions | What Happens in Retirement |

|---|---|---|

| Parking Fees | No | Stop at retirement |

| Union Dues | No | Stop at retirement |

| State Credit Union | Yes | Not automatic, must set up after retirement |

Taxes

| Paycheck Deductions | Pension Deductions | What Happens in Retirement |

|---|---|---|

| Federal | Yes | Tax rate varies based on marital status and allowances |

| State | Yes | If you live in CT or other state that taxes pensions |

| Social Security | No | Do not apply to pensions |

| Medicare | No | Do not apply to pensions |

Employee Separation Last Day of Work Checklist

For a list of items to consider on or prior to your last day of employment, please review the Employee Separation Last Day Checklist.

Contact Information

Human Resources will not have access to your retiree health benefits or your pension check. Contact the appropriate department at the Office of the State Comptroller with any questions you have. Contact information.

REEMPLOYMENT OPTIONS

Reemployment in a Temporary Position at UConn

The University may offer retirees an opportunity to return to or remain at UConn on a part-time basis. Reemployment is the prerogative of University and not an employee entitlement. Questions regarding reemployment opportunities and regulations should be directed to Human Resources at SPAR@uconn.edu.

Reemployment in a Permanent Position

If you are reemployed by the State in a permanent position after you have retired, your SERS pension payments and retiree health and life insurance benefits will cease. You must notify the Retirement & Benefits Services Division of your reemployment. You will resume membership in your SERS plan and receive credit for service during your reemployment. When you next retire, your SERS retirement benefit will be recalculated and will not be less than the amount you were receiving prior to reemployment.